There are two extremely worried, separate groups. One dreads the impact of economic expansion on the global environment, and the other worries about the impact of artificial intelligence. These groups should be working together. The unconditional Basic Income (UBI) is an payment to everyone, replacing means tested benefits and tax allowances, paid for out of income and resource taxes. The UBI can be justified purely on social justice grounds, and this aspect is comprehensively explained by the Citizen’s Income Trust, but their account does not deal with the ecological aspect

http://www.citizensincome.org/

This is also explored in my weblog ‘Page’ How and why the basic (citizens’) income is possible now

My book, ‘Citizens’ Income and Green Economics’ is available from The Green Economics Institute.

‘Pages’ in this weblog which go into more detail on the ecological aspects are:

Book Résumé;

The Tragedy of the Commons; and

Why climate breakdown is happening

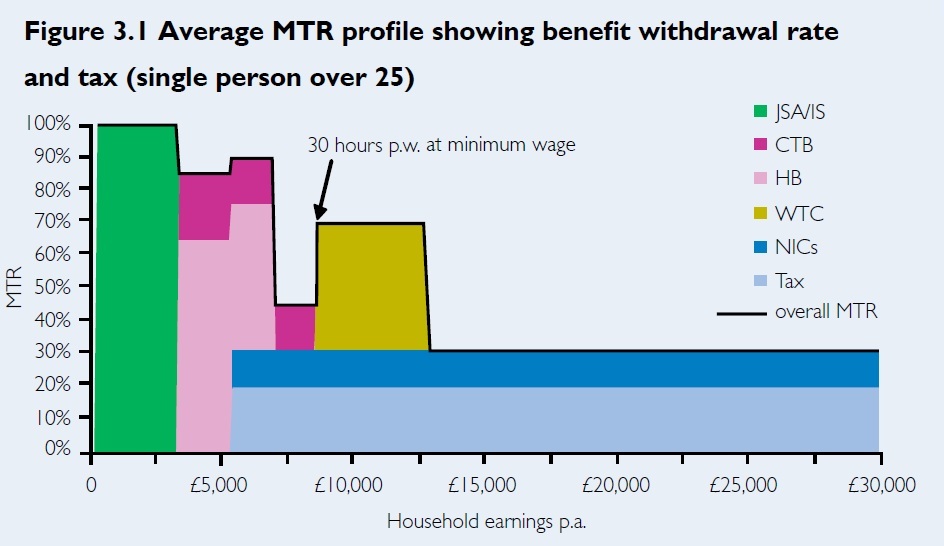

The fate of Easter Island demonstrates what happens when a culture which takes expansion for granted meets the limits of the environment to cope (see the first few paragraphs of the book résumé). I am terrified by the significance of melting arctic ice, ocean acidification as well as the growing intensity of extreme weather events. The graph on the right is a clue to the first step in a possible answer. Its immediate effect is to expose the fallacy in the ‘anti-scrounger’ attitudes prevalent in some sections of the media, and the fundamental weakness in the government’s workfare reform plans. At the time of this first update (July 2014), the Labour opposition strategy was that they would be better than the government at hounding scroungers, totally failing to see the ‘persuasion is better than force’ logic which is the basis of the UBI.

The graph at the top of this page illustrates the withdrawal of means tested benefits as though they were taxes. which they are for the person losing the benefit. It can be used to bring the BI mainstream. It reveals the Universal Credit as a ‘scrounger’ oriented answer. It is taken from page 88 of ‘Dynamic Benefits’, (Sept 2009 : click ‘Library’, p.9), Iain Duncan Smith’s own literature. The graph is for a single person, but there are similar graphs for various family situations. A simpler graph, for a family just showing the outline can be found on page 162. A similar, up to date graph appears in the RSA report on the Basic Income, dated 16th December 2015.

Ignore the colours. They are just the details of how the poverty trap/scroungers charter is made up (same thing, depends on your mind set). Concentrate on the black line at the top. The ‘Marginal tax rate’ is the amount you lose in tax or withdrawal of means tested benefits (exactly the same effect) for each extra £ earned. Draw a vertical line at, say £12,000 pa. You lose 70p from every £ through withdrawn benefits. Draw another line at £30k – you only lose 30p in tax and National Insurance.

The ‘Participation tax rate’ is the total you lose out of the total earned. To show this you look at the total coloured from the entire rectangle. You only keep the white bit at the top. Now compare £12k with £30k pa.

Now graft on the Universal Credit (UC) and the Basic Income. The UC graciously allows former scroungers, sorry benefit claimants, to retain 35% of their benefits. So on the graph, you draw a horizontal line at 65% to represent the tax equivalent, up to the point where all means tested benefits are withdrawn. This is better than now, but not much. It would still be necessary to use the whole apparatus of benefit sanctions. But this assumes the UC is actually functioning. The news item on the latest damning Public Accounts committee Report on the UC (3rd Feb 2016) states that 4 years after launch, 200,000 out of 4,500,000 who should qualify for the UC are actually receiving it, and the projected full rollout – not until May 2021 looks decidedly mythical.

The Basic income would draw a straight horizontal line across all income levels. Even at a flat tax rate all the UBI does is shift the tax or tax equivalent so that all incomes share the burden equally. Martin Wolf, Chief Economics Commentator on the Financial times has said it would have to be at least 60% if housing costs were included, but former ‘scroungers’ are paying more than that now as they lose benefits, and would continue to do so with UC. All the clap trap about why the Basic Income is unaffordable, would make people lazy, or would not work for whatever reason, is demolished by this graph. All the Basic, Citizens’ Income does is put everybody on the same footing, making benefit sanctions unnecessary, because it makes work pay.. The anti-cuts movement could use this thorough critique of means testing as powerful support for their case.

The Citizens’ Income will facilitate a fusion of ideas from the now outdated ‘right’ and ‘left’. Large numbers of ex-socialists and ex-conservatives who accept ecological limits will recognise that they have more in common with each other than with their former allies who still don’t realize how dangerous indiscriminate economic growth has become.

Ideas always evolve, but also, instead of, as hitherto, my railing at the TV or radio in impotent rage at an item where the CI is relevant but not mentioned, you will find it here. The whole idea is a huge thought experiment. The main purpose of the UBI is to give everyone a sense of security without economic growth. There may be better ways of achieving this, but no one has yet thought of them. A UBI, or something serving the same purpose, must become a reality. But that can only happen when there is a world wide consensus. This is an idea which needs to go viral. Workfare is lunacy at a time of serious unemployment .

[Second update March 2016, shortly after Iain Duncan Smith’s resignation as Work and Pensions Secretary; amended again in November 2019]